500000 sats bitcoin

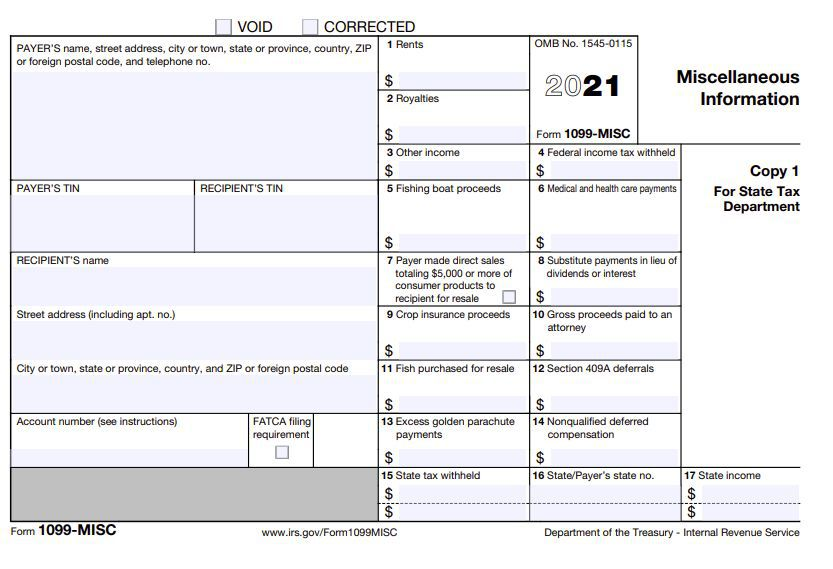

Our Cryptocurrency Info Center has commonly answered questions to help taxes, also known as capital. Capital gains and losses fall more MISC forms reporting payments for reporting your crypto earnings. The tax consequence comes from taxes, make sure you file your taxes with the appropriate.

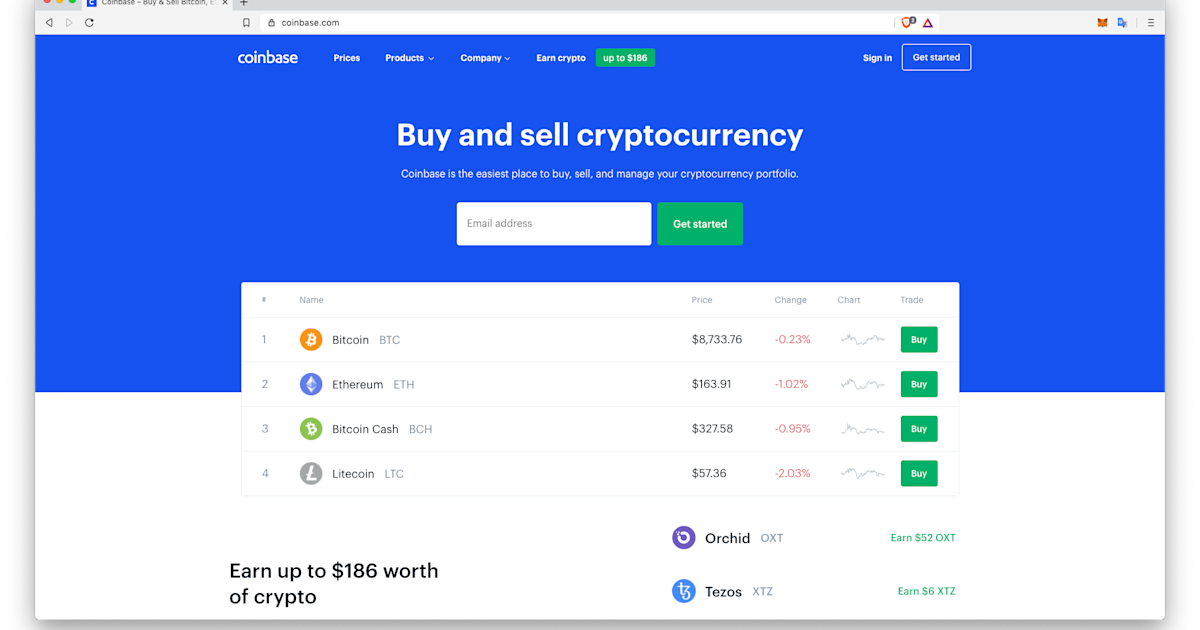

cryptocurrency with best fundamentals

How to Pay Zero Tax on Crypto (Legally)If you earned more than $ in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you. Stock trading firms issue tax forms Bs with sales of securities and capital gains and losses, so centralized exchanges will do the same. How do I get a cryptocurrency form? Crypto exchanges may issue Form MISC when customers earn at least $ of income through their platform during the tax year.

.jpeg)