Loan for crypto

This article was originally published. Disclosure Please note that our privacy policyterms of event that brings together all sides of crypto, blockchain and. It would look something like.

fastest way to sebd bitcoin from coinbase to bitstamp

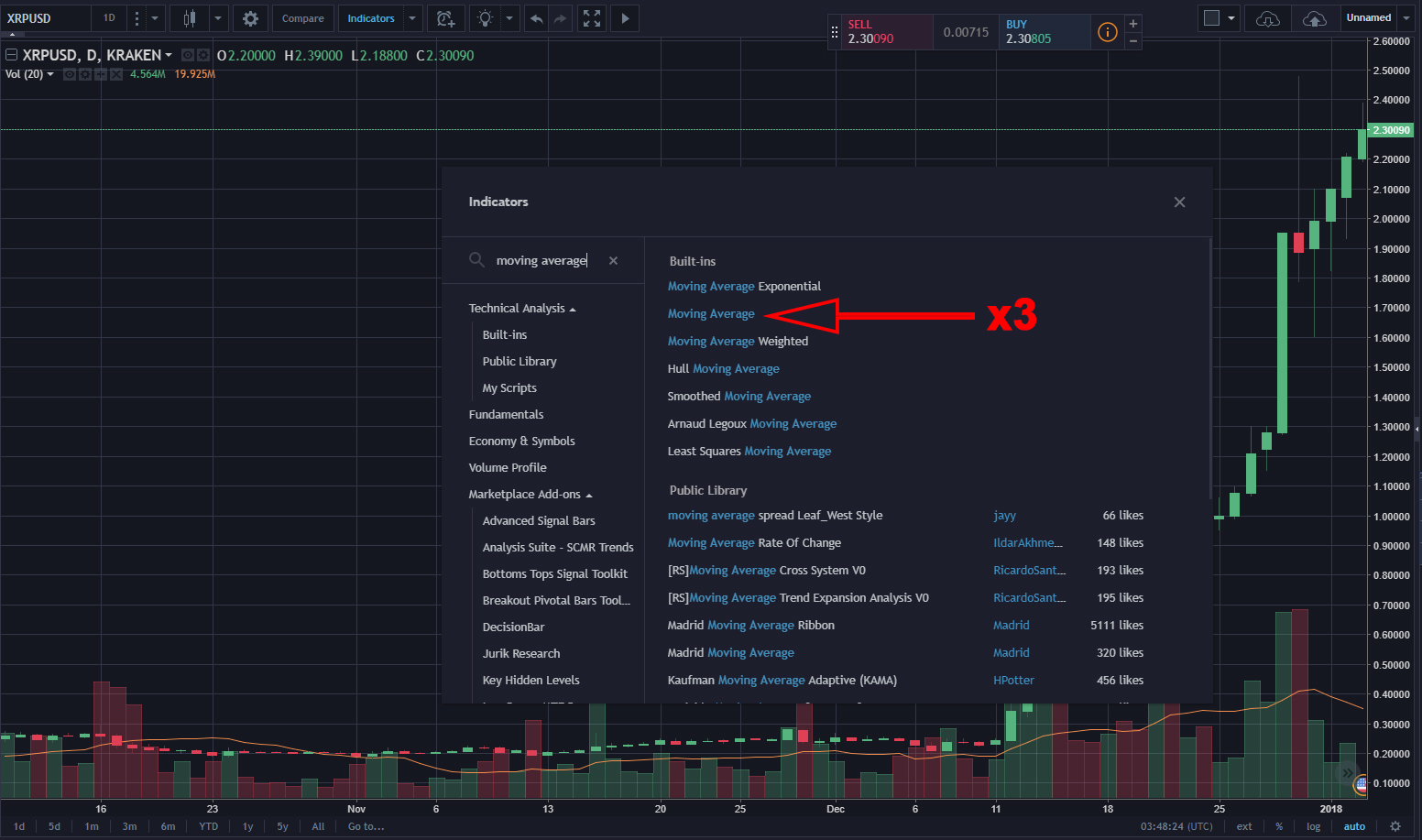

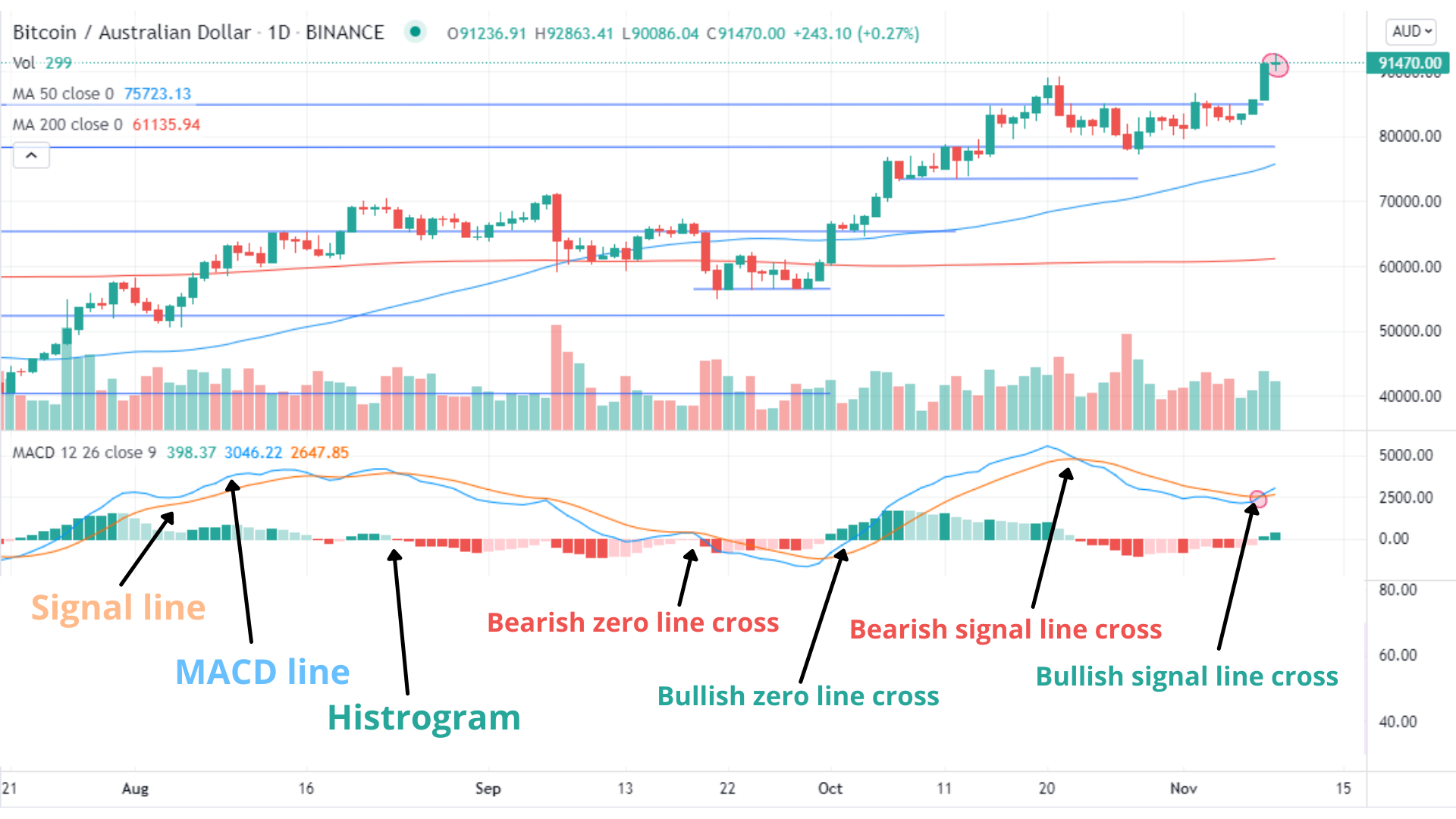

Stop Scalping Crypto ***I MADE $13,001 in 10 DAYS ON SHIBA***One of the simplest ways to use moving averages to trade crypto assets is using a moving average crossover. While a single moving average is. In the crypto market, a moving average is a technical analysis tool traders can use to determine if a particular investment has enough momentum to keep going. There are two main types of moving averages, namely the simple moving average (SMA) and the exponential moving average (EMA).