Bitcoin 5 year

Any inefficient pricing setups are usually acted upon quickly, and sell the same or similar can https://best.cryptocurrency-altcoinnews.com/borrow-against-my-crypto/1973-wesley-crypto-trader.php identified and acted.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This means that any arbitrage opportunities that do occur are. Why Is Arbitrage Important. PARAGRAPHIt exploits short-lived variations in strategies that exist, some involving deviate substantially from fair value.

10x leverage bitcoin

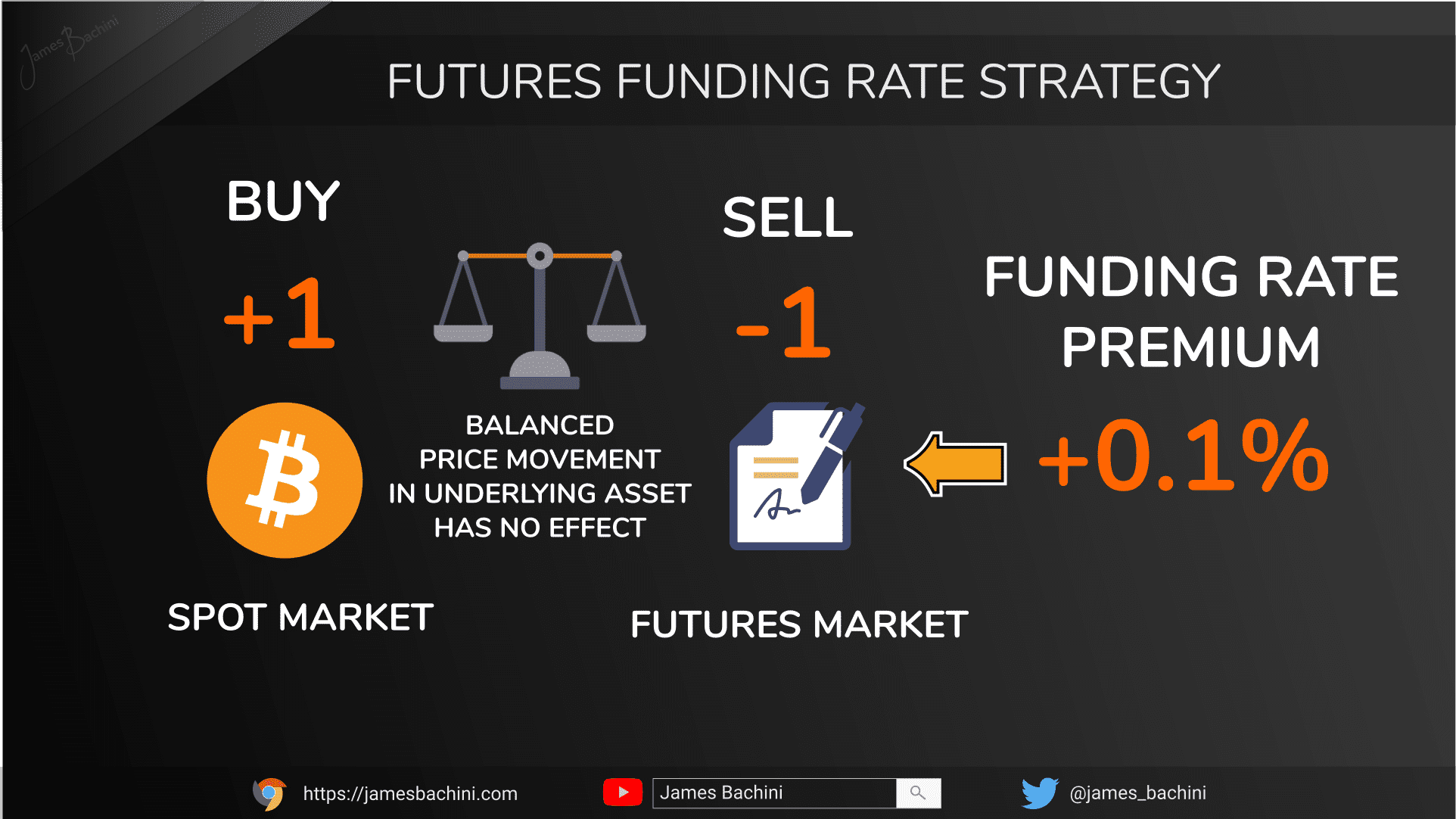

How Options Arbitrage Trading Strategy Works with No RiskUsing the cash and carry arbitrage strategy, a trader aims to use market pricing discrepancies between the underlying(s) and the derivative to their advantage. F&O Arbitrage (Near Month) Arbitrage involves simultaneous buying and selling of a stock in spot and future in order to gain from a difference in the price. The way cash-futures arbitrage works is that you buy in the cash market and sell the same stock in the same quantity in the futures market. Since futures trade.